Home Loan Preparation Guide

Employment Stability

Full-Time Employment: Lenders usually require at least 6 months in the same job.

Casual Employment: Generally, 12 months of continuous casual work is needed.

Self-Employment: Lenders often require 2 years of business history.

Every case is unique, and some applicants may qualify even with less time.

Credit History

Importance of Credit Report: A lender will review your credit file, which can impact approval—especially if borrowing more than 80% of the property value.

Improving Credit Health: Obtain a free credit report.

Clear outstanding debts.

Avoid new credit cards or personal loans 12 months before applying.

Deposit Size

Starting a Deposit Fund: Create a budget to help save for a down payment.

Aim for a 20% deposit, which is seen as less risky by lenders.

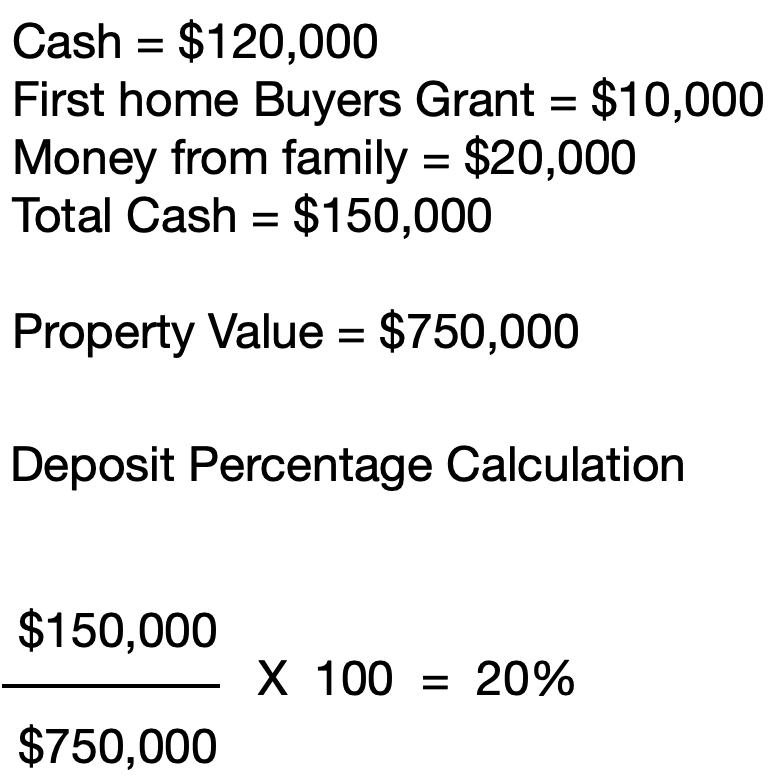

Deposit Calculation Example:

Less Than 20% Deposit Options:

Lenders may still approve a loan with Lenders Mortgage Insurance (LMI).

There are government programs for first-time buyers with a 5% deposit; contact me to see if you qualify.

Lenders Mortgage Insurance (LMI)

Trigger: Required if borrowing more than 80% of the property value.

Cost: Typically 2-3% of the property value, which can be included in the loan amount.

Savings Habits

Building Consistent Savings: Open a savings account for the deposit.

Make regular, consistent deposits over at least 3 months.

Avoid withdrawals and keep all extra funds in this account to demonstrate reliability.

Property Selection

Lenders prefer properties that are easy to resell, which influences their approval.

Guidelines for Property:

Size: Aim for properties over 50 square meters.

Location & Amenities: Some suburbs and specific features (e.g., parking, multiple bedrooms) make properties more favorable.

Condition & Red Flags: Properties in poor condition or with certain restrictions may face challenges.

Assets and Liabilities

Reduce Liabilities: Pay down unsecured debts, limit credit cards, and lower credit limits.

Examples of Assets:Savings, property, investments, vehicles, superannuation, etc.

Examples of Liabilities: Mortgages, credit card limits, student loans, personal loans, ATO debts.

Guarantors

Family Support: Family loans or gifts account for 30-50% of first-home buyer funding in some areas.

Guarantor Loans: Increasingly popular, especially for young buyers. Contact me for a free borrowing review and to assess if a guarantor loan could help you.

By following these guidelines and building a strong financial profile, you can improve your likelihood of securing a home loan.

Reach out for personalized advice or support in preparing for your application.

This site was created with the Nicepage